Vietnam is a case history in Southeast Asia. With political and economic successes, it has gained the trust of the EU and is preparing for the global stage

Vietnam is the flagship of Southeast Asia. The difficult years of decolonization seem a remote past. Today, Hanoi has a prosperous economy, stable political institutions and an effective international projection that has led it to sign important trade agreements. 2020 was a challenging year for everyone, but not for Vietnam, which was able to effectively prevent and contain the coronavirus pandemic (even if a new wave is now underway in the country) and then restart economically. Vietnamese economy grew by 2.9%, better than anyone else (including China and Taiwan) in Asia.

The confidence in multilateralism and the activism shown during the ASEAN presidency (which led, among other things, to the conclusion of the agreement on the Regional Comprehensive Economic Partnership) earned it the attention of the international community and the trust of the financial markets, especially the European ones.

Last winter, the outcome of the 13th Congress of the Vietnamese Communist Party summarized the dynamics underway. As noted by analysts, usually Communist Party congresses do not usually thrill the financial markets, but this year was an exception. The launch of an infrastructure development plan attracted foreign investors and projected the allocation of 119 billion dollars, as well as the commitment to increase the contribution of the private sector to the GDP growth from 42% to 55% by 2025. The free trade and investment protection agreements signed with the EU in 2019 are included in this scenario. According to Secondo Dezan Shira & Associates, there has been sustained growth in the flow of European FDI into Vietnam. This has been possible thanks to the revision of the normative environment that has welcomed more international players, thanks to greater protection on intellectual property and the increase in the maximum foreign shareholding in commercial banks from 30% to 49%.

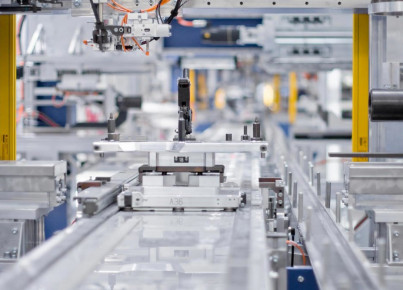

In general, Vietnamese commercial turnover has grown dramatically over the past 10 years. The fastest-growing industries are heavy industry and mining, which generated $ 57.58 billion in exports - a volume up 33% from last year, followed by the light and craft industries (27.5%) and agriculture and forestry (8.8%). The EU is Vietnam’s third-largest export destination, with $ 12.6 billion in entry - up 18.1% year-on-year. As Vietnam Briefingreports, the main EU exports to Vietnam include high-tech products, machinery and electrical equipment, aircraft, vehicles and pharmaceuticals. Conversely, the main Vietnamese exports to Europe are represented by telephone equipment, electronic products, footwear, textiles and clothing, coffee, rice, seafood and furniture. In this regard, a high amount of FDI in Vietnam comes from Italian companies, namely in the fields of the pharmaceutical, transport, machinery and food products industry. Here, the Italian economic system would have broad opportunities for growth, particularly in sectors with a high level of specialisation.

The path towards economic liberalisation has not been linear. The Socialist Republic of Vietnam has often followed the footsteps of China, starting with the economic reforms inaugurated around the 1980s, and was inspired by the experience of its socialist neighbour in defining productive structures: a growth model based on heavy industry, a communist political philosophy, low labour and land costs that now support high exports. All these elements make Vietnam the worthy heir to the so-called "Chinese model", but Hanoi has its own vision of the future.

The national leadership has been able to carve out a certain autonomy in the regional geopolitical context. Through enviable diplomatic balancing skills, he dodged the flattery of former US Secretary of State Mike Pompeo while remaining firm with China on matters concerning the South China Sea. Thanks to its strategic role, Hanoi has avoided US sanctions, despite allegations of currency manipulation. Moreover, Vietnam was indirectly involved in the commercial tension between Washington and Beijing, benefiting from the re-localization of some multinationals that moved from southern China to more favourable political and commercial contexts. Compared to Beijing, Hanoi adopted an assertive but responsible approach, proving that the leadership’s projects aim at carving out an autonomous space within the regional context.

Not surprisingly, Vietnam is becoming the EU target market in Southeast Asia. Despite these similarities with the Chinese model, Hanoi’s attitude has proved to be more easily integrated with the context of multilateral cooperation with the EU. With respect to human rights and workers' rights, there are some grey zones, not fully protected by a centralist regime that does not admit clear dissent. But in trade and geopolitical terms, Vietnam has proved to be a stable and reliable regional partner, though uncertainties remain, from the coup in Myanmar to the positioning of the Philippines.

The current growth of the EU's FDI in Vietnam seems to be just the beginning. If even the contingencies of the pandemic did not hinder its progress, one has to look even more carefully at the future developments of this emerging Southeast Asian economy.