Political tensions and economic competition are slowing down the race towards the green transition. The war in Ukraine is changing Russian fossil fuel routes, but supply agreements are particularly advantageous for partner countries such as China

2022 was a black year for climate diplomacy. Although the 2021 Conference of the Parties (COP26) seemed to have rekindled decision-makers' focus on the climate crisis, the natural disasters that followed, the war in Ukraine, and a further slowdown in the markets have contributed to a completely different trend this year.

COP27 saw presidents from some of the major global economies rushing past on their way to the G20 summit in Bali, while delegations from the most fragile countries only got the promise of funds for loss and damage, i.e. economic compensation for suffering the worst effects of climate change. Although not reaching the agreed quota of USD 100 billion, this decision was hailed by many as a first milestone towards climate justice. However, as new models by climate researchers demonstrate, the damage resulting from the climate crisis is far greater than has been calculated so far. Today, many of the world's most endangered cities are in Asia, including several major regional capitals such as Bangkok, Ho Chi Minh City, and Manila.

The meeting between US President Joe Biden and his Chinese counterpart Xi Jinping on the side-lines of the G20 summit has revived the rollercoaster of climate diplomacy, creating a sense of cautious optimism following commitments from the world's two biggest polluters. However, Washington and Beijing's actions are not yet consistent with their narrative of each country’s 'leading' role in the green transition. Looking east, China's promise to offer alternative models of sustainable development is still far from supporting the most urgently needed reforms. Neither the more heterogeneous ASEAN bloc nor the advanced East Asian economies seem ready for a rapid energy transition and achieving carbon neutrality. The first target is 2030, when Japan promises to have cut emissions by 46 per cent compared to 2013 figures, China aims to peak its emissions, and South Korea is bound by the Global Methane Pledge to reduce methane emissions by 30 per cent compared to 2020. China is missing from the latter mechanism, and has also released itself from the loss and damage fund.

South-East crossroads of interests

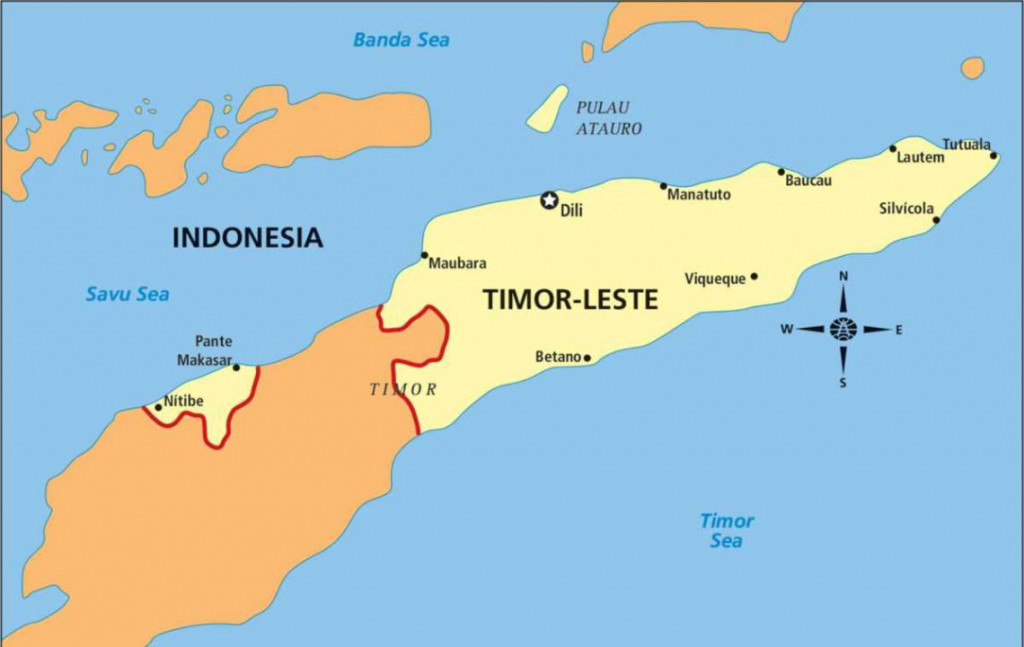

Another interpretation of China's decisive role sees Beijing as the leader of a 'positive competition' with Washington, where the two countries seek to gain status (and budget) from their dominance in multilateral forums and in the market for energy transition technologies. But recent US manoeuvres targeting the semiconductor sector and manufactured goods produced in Xinjiang (which mainly include solar panels) risk turning competition into rivalry. What is certain is that China's promises combined with economic interest are having an impact on the countries most dependent on Chinese funding in the fossil fuels sector. One example is Vietnam, which must now consider whether to build new coal-fired power plants in the absence of Chinese capita due to Beijing's promised ban on foreign investment in the sector. Nevertheless, Southeast Asia's energy demand continues to rise, having grown more than 80 per cent in less than twenty years, and the easiest and most immediately available options are the most polluting energy sources, which continue to occupy more than 80 per cent of the region’s energy mix. Financial incentives also accompany the more practical availability of cheap natural resources, as in the case of Indonesia, which is the world's third largest coal exporter. Furthermore, the war in Ukraine is changing Russian fossil fuel routes, with supply agreements which are particularly advantageous for partner countries such as China.

Southeast Asia is at the crossroads of the interests of new investors avoiding China and older relationships rooted in the economic fabric of different countries. Japan, the main investor in Thailand in 2022, has long been eyeing the opportunity to build electric cars and components necessary for the energy transition. There is also a strong interest in new sustainable agricultural supply chains, as well as in businesses that can transform the tourism sector according to parameters more consistent with the UN agenda for sustainable development. In this case, the challenge is much broader than merely addressing the energy dossier, because it requires deep reflection on the environmental and social impacts of sectors that have driven the economies of several countries in the region over recent decades.

The challenges of sustainability between India and Central Asia

Far from the spotlight of climate diplomacy, but extremely important for its economic and demographic weight, India has to reckon with the challenges of uncontrolled modernisation. The unbridled growth of its cities is not matched by reasoned urban planning (think, for example, of private vehicle traffic), while water resources and soil health have plummeted since the 1950s. The evidence on the ground is not yet matched by an awareness of playing a proactive role at the climate negotiation table. Even for New Delhi, competition with China is a priority. Furthermore, while on the one hand the Indian government forms new working groups for the enforcement of multilateral agreement directives, on the other hand it moves to repress environmental organizations and activists.

Finally, Central Asia focuses on climate change adaptation measures rather than demanding more responsibility from the big polluters. While in some places like Kazakhstan the race for economic leadership in the region seems to overshadow environmental promises, in other countries such as Kyrgyzstan there is a strong concern about extreme climate phenomena and food security. The competition over water resources, which has recently emerged with clashes along the Kyrgyz-Tajik border, also opens dangerous scenarios of climate change as an accelerator of conflict in the region. The main promise, as stated by the leaders involved in the UN environment agency's project on climate security in Central Asia, is to work together with international organizations to build a socially and economically sustainable adaptation strategy. Here too, however, the role of a prominent player like China could influence the design and electrification choices of newly urbanized areas. Looking at the resources in the area (water sources along the border with Xinjiang, natural gas wells), another side of the coin becomes visible: predatory scenarios that are not new in Asia, such as the case of the Chinese dams along the Mekong Delta.