Africa and ASEAN have almost the same parallel path in the development of the digital economy and the interest shown by the two blocs to walk it side by side increases

By Tommaso Magrini

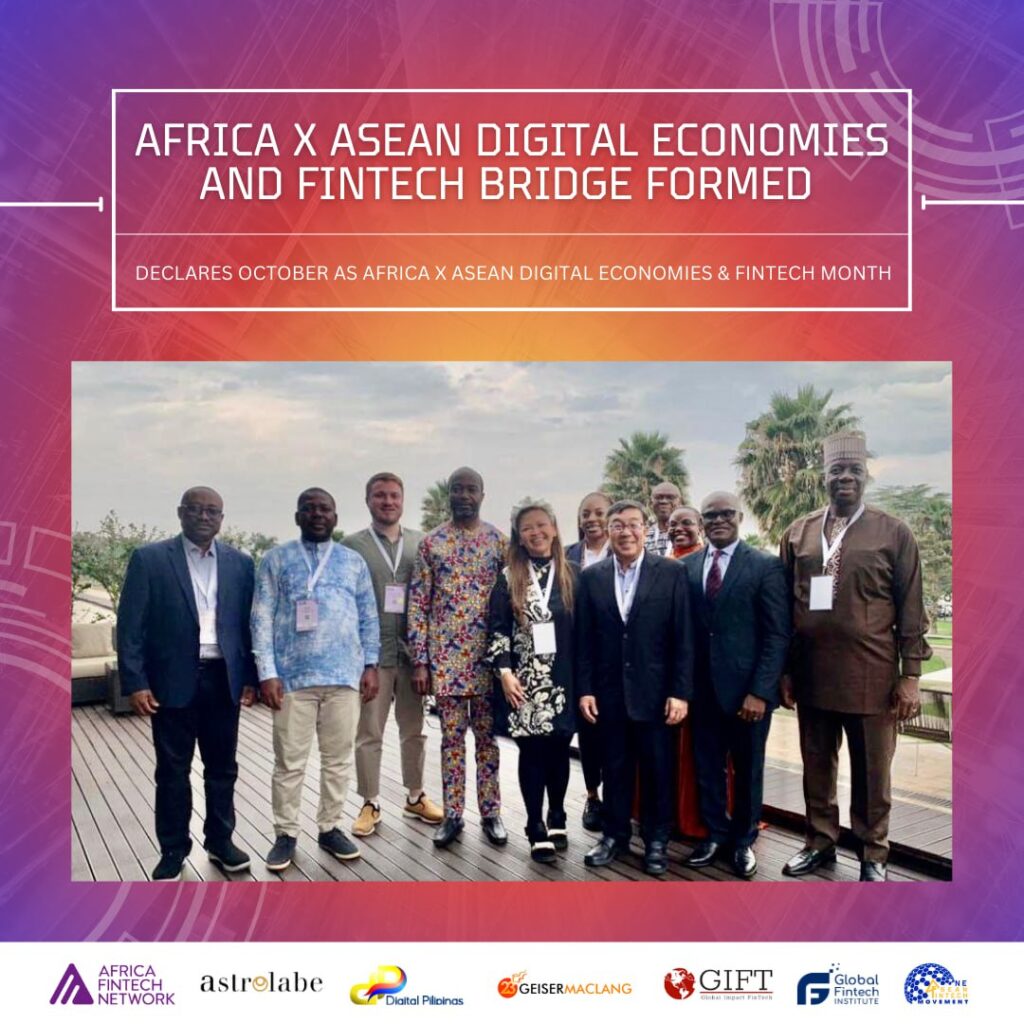

Africa and ASEAN have signed a partnership agreement to promote digital economies, identifying fintech, decentralised assets and fundraising as a point of convergence. The signing took place at the Fintech Forum in Kigali, Rwanda, in the presence of regulators, heads of associations and leading fintech and technology companies from the two regions. This important agreement marks the beginning of collaboration between the two regions in the areas of advocacy, fundraising, payments, lending, decentralised assets, start-up development, regulatory exchange and training. Both Africa and ASEAN are expected to grow exponentially in the digital economies space, with global projections for ASEAN growing by 6% per year, reaching $1 trillion by 2030. Africa, on the other hand, is projected to grow by $712 billion by 2050. Professor David Lee, co-founder and chairman of the Global Fintech Institute, said: 'With the launch of the Chartered Fintech Professional (CFtP) qualification programme in collaboration with our partners, Digital Pilipinas and Africa Fintech Network, the GFI is committed to leveraging this partnership to empower and nurture future generations of fintech talent in ASEAN and Africa with a global mindset, a rigorous knowledge framework to constantly keep abreast of industry developments and trends, and strong ethical standards. This is just a start, we will launch even more digital literacy programmes." Africa and ASEAN have almost the same parallel path in the development of the digital economy and the interest shown by the two blocs to walk it side by side with African Fintech Leaders ensures that engaging and investing in the combined population of 2 billion people as a fintech market will be a primary agenda of many companies, countries and organisations.